Imagine setting aside just $5 a day—the cost of a latte—and watching it grow into $100,000 over time. This isn’t a fantasy; it’s the magic of compound interest, a force that transforms modest, consistent investments into life-changing wealth. Whether you’re a 25-year-old starting your first job or a 45-year-old planning for retirement, understanding compounding is the key to unlocking financial freedom. In this guide, we’ll explore how small, disciplined investments can snowball into extraordinary returns, why time is your greatest ally, and how to avoid common pitfalls along the way.

The bedrock of compounding are break down. the "Eighth Wonder"

Compound interest is similar to simple interest, IT grows linearly. compounding earns returns on both your initial investment and the accumulated interest over time. Here’s the formula that powers it:

[ A = P \times (1 + \frac{r}{n})^{nt} ]

A = Future value

P = Principal (initial investment)

r = Annual interest rate (decimal)

n = Number of times interest compounds per year

t = Time in years

For example, a $10,000 investment at 7% annual interest compounds to $76,123 in 30 years.

2. The understanding for part early personify the time factor. Matters

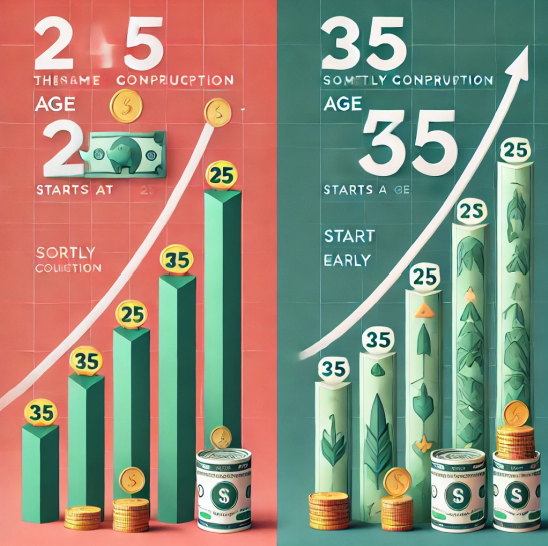

Let’s compare two hypothetical investors:

- Sarah starts investing $200/month at age 25.

- John begins investing $200/month at age 35.

Assuming a 7% annual return:

- By age 65, Sarah’s portfolio grows to $525,000 (40 years of contributions).

- John’s portfolio reaches $245,000 (30 years of contributions).

Despite investing the same monthly amount, Sarah’s 10-year head start nearly doubles her final balance. compounding is possible because of the time. making early action critical.

3. Practical Strategies to Harness Compounding

Automate Investments

Set up automatic transfers to brokerage or retirement accounts. Even $50/week grows to $135,000 in 30 years at 7% returns.

Reinvest Dividends

Reinvesting dividends from stocks or ETFs accelerates growth. For instance, $10,000 in the S&P 500 with reinvested dividends grew to over $800,000 from 1980 to 2020, versus $300,000 without dividends.

Increase Contributions Over Time

Boost investments by 3% annually (matching raises or inflation). Starting at $200/month and increasing contributions yearly could add an extra $100,000 to your portfolio.

4. Common Mistakes That Derail Compounding

Withdrawing Early

Pulling money out of the market resets your progress. A $50,000 portfolio left untouched for 20 years at 7% becomes $193,000. Withdrawing $10,000 at year 10 reduces the final balance to $147,000.

Chasing High-Risk Returns

Overconcentration in volatile assets (e.g., meme stocks) often leads to losses. Diversified index funds historically deliver steadier 7–10% annual returns.

Ignoring Fees

A 1% annual fee can erase 28% of your potential returns over 30 years. Opt for low-cost ETFs or mutual funds.

5. Real-Life Success Stories and Calculations

Case Study: The Janitor Who Amassed $8 Million

Ronald Read, a gas station attendant and janitor, quietly invested in dividend stocks for decades. His secret? Consistent contributions and reinvesting dividends.

Monthly Investment Calculator

| Monthly Contribution | 30-Year Total (7% Return) |

|-----------------------|---------------------------|

| $100 | $113,000 |

| $300 | $340,000 |

| $500 | $567,000 |

Even small increases in contributions yield outsized results over time.

Conclusion

Compounding isn’t a get-rich-quick scheme—it’s a get-rich-sure strategy. detain reproducible and starting early be what one do. avoiding common traps, you can turn spare change into generational wealth. 20 was the best time to works a fiscal tree. years ago; the second-best time is today. Open a brokerage account, automate your contributions, and let time and compounding do the heavy lifting. Your future self will thank you.